Bainbridge Real Estate 2016 In Review

My Top 10 Homes on Bainbridge Island | 2016

January 9, 2017

More Economic News for 2017 | Gardner Report

January 30, 2017

A Promising Start to the New Year

Familiar Themes

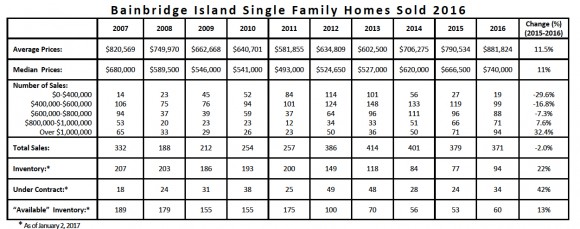

With regard to the Bainbridge Island real estate market and its year-end numbers, the similarities between 2016 and 2015 are striking. In both years, the market struggled with a lack of inventory and strong demand, while the market trends (that actually began in 2013) continued to respond to this condition. What makes 2016 special is we surpassed most (if not all) of the records set in our last ascending market of 2004-2007. While it makes some people nervous to be in this rarefied air, with the uncertainty that can accompany it, we don’t foresee any specific event that will change our market trajectory in 2017 (with one possible exception, which I will discuss later).

Record-Setting Prices

The median price of a home sold on Bainbridge has never been higher than in 2016. Even more impressive is the growth in the median, which has risen steadily since bottoming out in 2011 following the difficulties that began in 2007. In only five years, our median has grown from $493K to the current $740K – an increase of 150%. In that time, we officially drew even with and then surpassed the 2007 peak median of $680K. This is welcome news to all those sellers who have been hanging in there, whether they wanted to or not, waiting for prices to climb back up.

Our upper end has been the last market segment to enjoy our market’s resurgence, and finally joined the party in 2016. Sales over $1M were up 32.4% from 2015 and up 88% from 2014. Not only did we set a new “highest price sold” of $5.97M but we had five sales over $3M. Previously, the highest price for a home sold was $3.497 in 2007. Also for comparison, in the ten years between 2005 and 2015, there were only eight homes sold for more than $3M (an average of less than one, compared to the five sold in 2016).

Condos, Land and New Construction

Our condominium market also experienced a resurgence. In 2008, there were only 42 condominium sales on the island; in 2016, we had 104 sales distributed over all price ranges – the largest number since 2007. The condominium valley floor was in 2012 with a median price of $297K. In 2016, by contrast, we raised that by 35%, reaching a median of $400,750.

Although land sales were down last year (for reasons that are unclear, but we suspect a cyclical reaction from 2015’s exceptionally strong sales), new construction seems to be everywhere (especially in community centers). There is a plethora of multi-home projects underway across the island. Some are being developed by local owners, but we have also seen an influx of off-island larger development companies. New communities under construction: Ashbury – Off Wyatt – 18 residential homes (off-island developer); Landmark – Off Wing Point Way – 17 residential homes (off-island developer); Ferryview – Off Wing Point Way – 11 condominiums (off-island developer); Roost – Off Baker Hill – residential, commercial and townhomes (island developer); Pleasant Beach Village – 14 view condominiums (island developer). There are also many multi-home projects in the planning/permitting stage (Weaver, Finch and Torvanger to name a few).

The Density Trend

The development we’re seeing in places like Winslow and Rolling Bay addresses a sentiment we’ve been hearing from our clients for years: “We want to downsize and move into town.” As the higher end has become healthier, people have been able to achieve their goals of selling their larger homes (to enthusiastic new buyers!) and moving to smaller homes or condos in denser community centers. We anticipate Lynwood Center will also benefit from this trend as new homes come online (like The Roost and Pleasant Beach Village Townhomes and lots).

Moving Parts

Moving Parts

We’re keeping a close eye on interest rates, which are slated to go up again sometime soon. The concern is they rise to a point where they materially affect mortgage payments (and therefore home prices). Loan rates are still exceedingly affordable, so let’s hope they stay that way.

Demand will probably not be a concern for 2017, and supply will still most likely lag demand. We have new projects coming on-line now and throughout the year, but we still see some clients waiting to sell their homes (adding to inventory woes) because there aren’t yet enough choices on the market to justify the risk of having nothing to move to once they sell. The new projects will help, especially because they provide what current potential sellers have been asking for, but we see overall demand still exceeding supply. As much as last year? That could depend on what happens in Washington DC . . .

I Wish I had a Crystal Ball

Will 2017 go down the same growth-oriented path as 2015 and 2016? Will the change in federal leadership have a negative impact on our market? Obviously, we can’t predict unforeseen events, but the economic outlook for our region is very positive. Professional and business services jobs are predicted to grow 3% in the Seattle Metro area next year. Computer and mathematical jobs up 3.5%. All that growth without any new transportation infrastructure only makes Bainbridge look increasingly appealing. People continue to look beyond King County, and many are excited to discover the beauty and quality of life found on Bainbridge Island.