Bainbridge Real Estate 2015 3rd Qrt Review

Bainbridge Island Pumpkins . . . and beyond

October 12, 2015

3rd Quarter Gardner Report | Western WA Real Estate

November 18, 2015

A Numbers Game

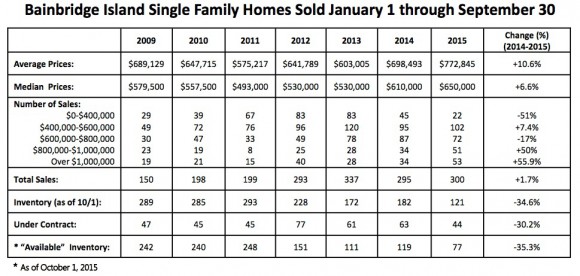

This year’s third quarter provides a great illustration of individual market forces, but what you see on the surface does not necessarily provide the whole story. So let’s look behind the scenes at what’s going on. At the end of June when we closed out the second quarter, the number of homes sold was up 14% from 2014. July was a good month but in August the number of homes sold was down 31% from 2014 and by September sales were down 25%. By the end of September, the 14% increase over 2014 had shrunk to a 1.7% increase in homes sold over 2014. This begged the question: has our great recovery already begun to falter?

Motivated Buyers

If demand was cooling, then we would expect to see fewer multiple-offer situations on individual homes. In the second quarter, 50.4% of our sales sold at or above their original list prices, which is a lot for Bainbridge. Then, in the third quarter, that already impressive number of sales “at or above asking price” went up even higher to 53.2%. This tells us that there were plenty of motivat- ed buyers, so the reason for the decrease in sales is not demand.

A Middle Market in Demand

The largest number of buyers looking on Bainbridge are seeking homes priced between $500K and $1M. They are sophisticated, knowledgeable and aware of their alternatives (both on and off the island). As illustrated above, there are still many potential buyers for homes on Bainbridge, but market forces here on the island are forcing them to wait or even go elsewhere. Of the 58 sales at list price or above, 64% closed between $500K and $1M. So if there is so much demand, why have sales tapered off? Choices are fewer and prices are higher.

Low Inventory + High Prices = A Slower Pace

Regular readers of this blog will notice that we’ve been complaining about lack of inventory since 2014. In the third quarter of 2014, the average available inventory (homes not under contract to be sold) was 135 homes as compared to 2012’s 162 homes (and don’t even ask about 2008). This year, there were only 73 average available listings – just over half of the number available in 2014. On September 30th of this year, there were only 32 available homes priced between $500K-$1M, the segment where 60% of the total sales of this year occurred (178 homes sold). The bottom line: there are just not that many choices.

Exacerbating inventory woes is the fact that prices are climbing higher, which takes many potential buyers out of the running. The middle price band has seen some of the best price appreciation, getting back to and in some areas exceeding our peaks of 2007. Buyers have financial limits and are more cautious than in the go-go years of 2005-2007 where misplaced optimism rationalized spending more in anticipation of the “forever” ascending market. These days, not only are there fewer choices, there are only so many of those choices that are financially feasible. And, of course, buyers have to like a house to want to go forward. In combination, all of these factors mean that buyers are often waiting or going down other paths.

When Bainbridge Buyers Make Other Plans

The North Kitsap market (defined as Poulsbo to Hansville) has traditionally benefited from price appreciation on Bainbridge. There are many choices (there were 200 available NK listings on September 30th versus our 77) for less money (NK’s median price at the end of the third quarter was $320,500 compared to our $650K). Sure enough, NK’s sales through the third quarter are up 15% (as opposed to our 1.7%) and the sales in houses priced from $400K to $800K are up 68.5%. We must assume that certain NK buyers looked first on Bainbridge before expand- ing their search to the north looking for better deals.

Some buyers opt to build when housing options are few. Land sales are up 36% (there have been 49 sales through October 1st in 2015 versus 36 in 2014). We have not seen this many sales through September since 2005 (when we had 69). Our peak was in 2003-2004, when there were more than 80 land sales through the third quarter in both years. This recent demand for land has also translated into a jump in the median price, from 2014’s $175K to this year’s $239K. There have been 40% more land parcels sold over $500K than last year.

The Condo Report

The Condo Report

The lack of choices has also dampened our condominium market. Sales are now down 9% for the year (73 in 2015 versus 80 in 2014) while the median price is up a healthy 18%. When you look at the average available inventory of 9 condominiums for the third quarter (which includes all condos in all price ranges), 25 sales for the quarter does not seem that bad.

What Is and Isn’t Certain

It is hard to predict what the fourth quarter will bring. Inventory will be a deciding factor, to be sure. The buyers will be there, but will they be able to find what they want at prices they can afford?

Regardless of what’s happening in real estate, I always remember how fortunate we are to be able to live on this beautiful island. When we look at the greatest contributor to our job market and personal real estate wealth – Seattle – we see a thriving job environment and plenty of conditions (such as traffic) that will continue to supply us with buyers fleeing the urban bustle. The next few years are going to see more and more people come into Seattle to work, and as they sit in traffic many of them will look somewhat forlornly at the ferries carrying other members of the workforce to our island where they will come home to great neighborhoods, schools, parks and all the qualities that make Bainbridge so unique.